Fixed Deposit – Grow Your Wealth with Money Gold Co-operative Society

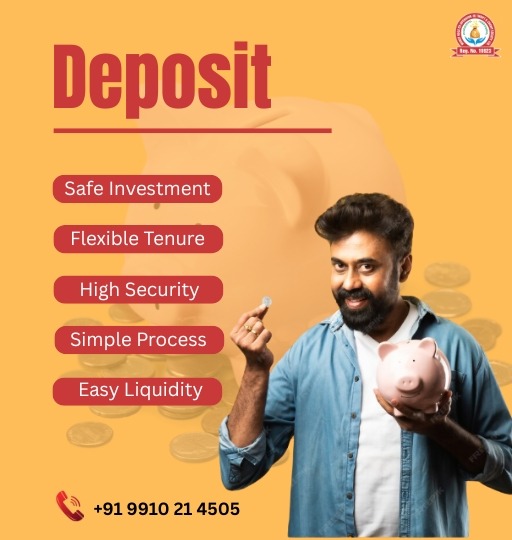

At Money Gold Co-operative Society, our Fixed Deposit (FD) Schemes are designed to help members secure their money while earning attractive returns. With disciplined investment over a fixed tenure, your savings grow steadily in a safe and transparent environment.

Members can choose from flexible tenures: 1 year at 10% p.a., 2 years at 11% p.a., and 3 years or more at 12% p.a. All interest is compounded yearly, providing maximum benefit from your investment. Our FD schemes also come with a special feature: your deposit can double in 74 months, ensuring assured growth.

The Fixed Deposit Plans at Money Gold Co-operative Society encourage disciplined savings while offering security and reliable returns. Members can invest according to their financial goals and enjoy the peace of mind that comes with safe, cooperative-managed deposits.

By choosing our Fixed Deposit Schemes, members gain access to high interest rates, assured maturity amounts, and a fully transparent investment process. Each deposit is backed by the society’s principles of trust, cooperation, and collective financial progress.

Start growing your wealth with Money Gold Co-operative Society Fixed Deposits today — secure your financial future while enjoying disciplined, high-return savings.